Accurate

An accurate and updated compliance checklist ensures labour compliance to prevent penalties and fines.

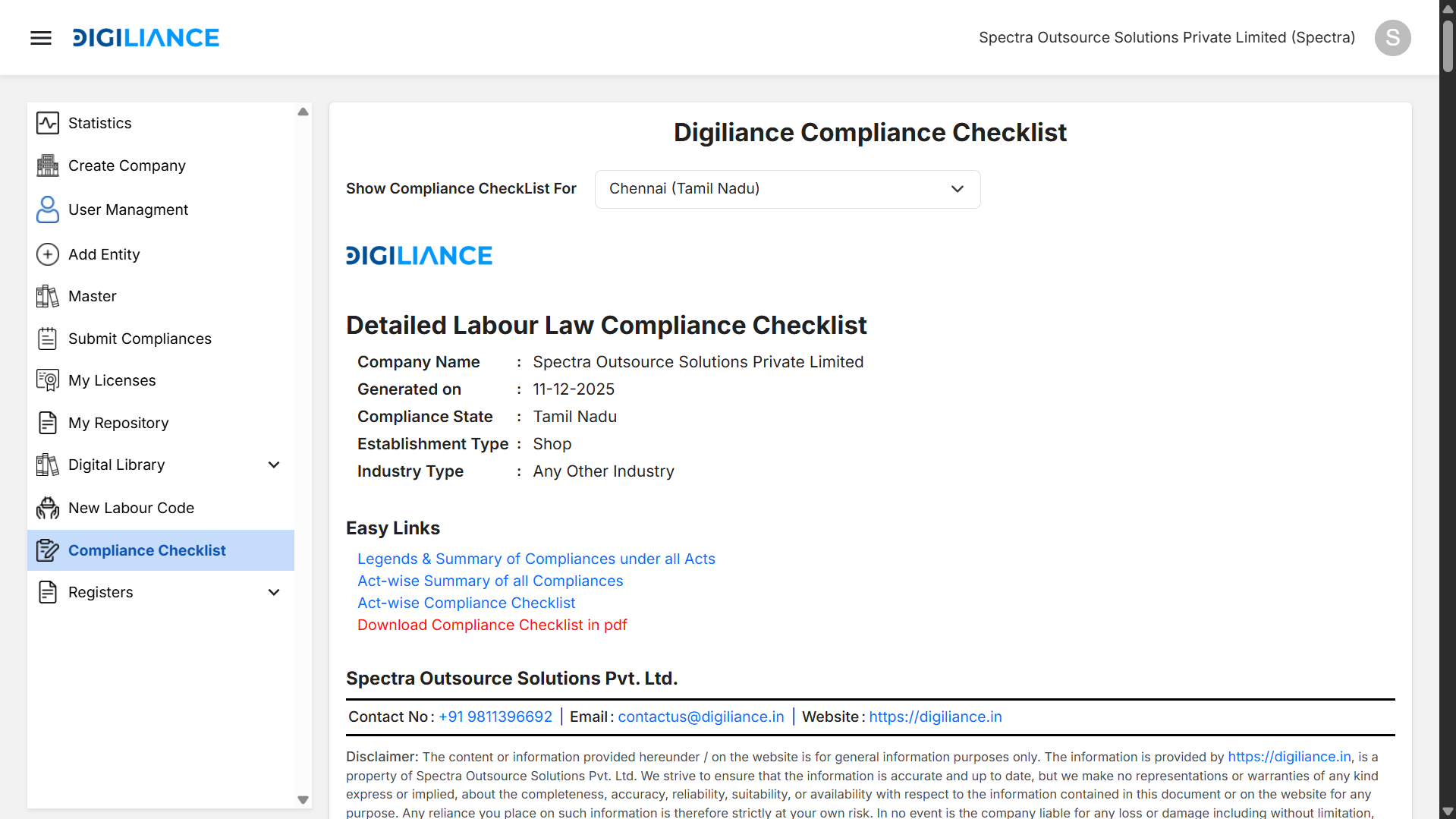

Get the latest and most accurate labour law customized checklist to your industry, state and headcount which includes the latest and updated information on all compliances under relevant acts and rules applicable to your organization.

Digiliance’ s industry-specific, tailor-made checklist helps you track all necessary compliances, ensuring you meet legal requirements and avoid penalties. Stay ahead of potential legal issues with a personalized approach that simplifies compliance management.

An accurate and updated compliance checklist ensures labour compliance to prevent penalties and fines.

Simplify state-specific regulations in one unified checklist to ensure full compliance.

Segregate industry-specific compliances for establishments under Central or State Government authority.

Map compliance line items based on headcount and gender to ensure tailored regulations.

Ensuring compliance with labour laws is critical for businesses to avoid legal penalties, fines, and reputational risks. Digiliance offers a comprehensive Compliance Checklist to help organizations track and manage their statutory obligations with ease. This checklist serves as a structured guide, ensuring that businesses meet all mandatory legal requirements under the New Labour Codes and other relevant laws.